I’ve heard the word “ignorant” used a lot in frustration toward 2016’s election. People throw their hands up: how do you fix ignorance?

Activism is local. Make it really local: educate yourself. Find an issue you don’t know a lot about, and then find a way to learn more. Maybe you know a lot about feminist issues, but not much about racial justice. Maybe you know about environmentalism, but not trans rights, or what it feels like to be an immigrant.

Find your own weaknesses and confront them.

There are lots of ways to research and learn.

Personally, I rely on two main sources: feeds, and books.

Justice Education Through Feeds

I get a lot of my ongoing social justice education through sources I stumble across and add to my feed reader. Two consistent sources I love:

Personal essays on disability in the New York Times

Intersectional feminism & personal discussion of being trans*, queer, and polyamorous by Robot Hugs (excuse the clickbaity titles added by the publisher– I subscribe to robot-hugs.com, which includes the artist’s comics on these topics and others, such as cats)

Another good source is people on Twitter who are active in native rights, racial justice, penal issues, etc. . If you know of great sources, please let me know!

Seeking Perspective in Books

Books are, and always have been, my mainstay. Long-form writing lets authors show you a world– whether that’s fantasy, history, or personal truth.

Walk a few hundred pages in someone else’s shoes.

There are some great reading challenges going around.

Ashe Dryden’s “Unpresidented” reading challenge highlights a marginalized group for each month of the year

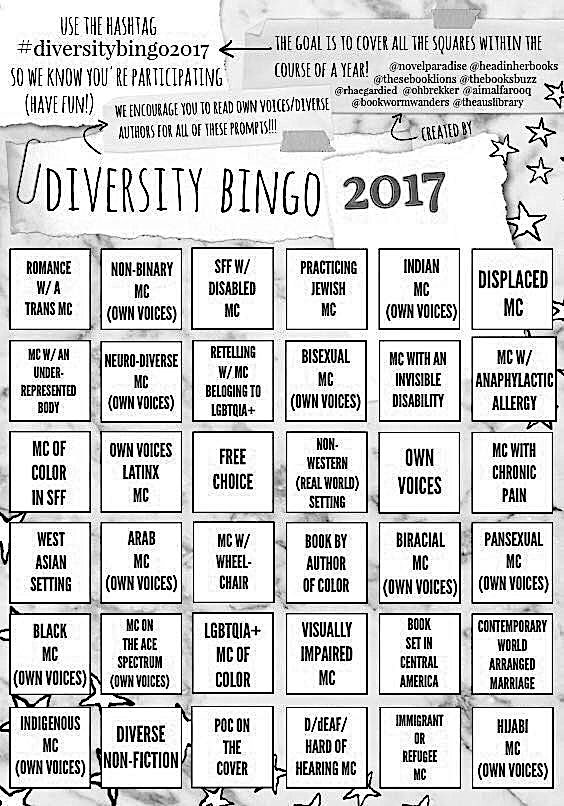

The #DiversityBingo2017 card is all over Twitter right now as people suggest or declare books for each category.

The #DiversityBingo2017 book bingo card

The basic idea is to expand your worldview by listening to a perspective you don’t usually hear.

Is this enough?

Of course not. Educating yourself is a really good idea, and it does fight ignorance. But it’s not enough by itself. Here’s what it does:

Educating yourself– every day– keeps these issues on the top of your mind. If you build empathy education into your routines, you’ll think about these issues. You’ll talk about them.

Education shapes thought; thought shapes action. It’s a start.